We all know the basic rules of personal finance: spend less than you earn, save for a rainy day, and avoid high-interest debt. It sounds so simple on paper.

Yet, in practice, it’s incredibly difficult.

If you already have a savings plan but find yourself constantly falling off the wagon, the problem likely isn’t your math skills—it’s your mindset. In 2026, the world is designed to make us spend emotionally. Apps are gamified to make buying feel good in the moment, even if it feels terrible when the credit card bill arrives.

To truly change your financial future, you have to look beyond the spreadsheet and understand why you spend the way you do. Here is a friendly guide to mastering your money mindset.

1. Understanding the “Dopamine Cart”

Have you ever had a bad day at work, scrolled through an online store, added five things to your cart, and suddenly felt a little rush of relief or excitement?

That’s dopamine—a chemical in your brain associated with pleasure and reward. In our modern world, clicking “buy now” is the fastest, easiest way to get a dopamine hit. The problem is that the feeling is temporary. The excitement usually fades before the cardboard box even arrives at your door, leaving you with guilt and less money. recognizing this cycle is the first step to breaking it.

2. Identify Your Emotional Triggers (HALT)

We rarely impulse buy when we are calm, content, and well-rested. We usually spend money to fix a negative feeling.

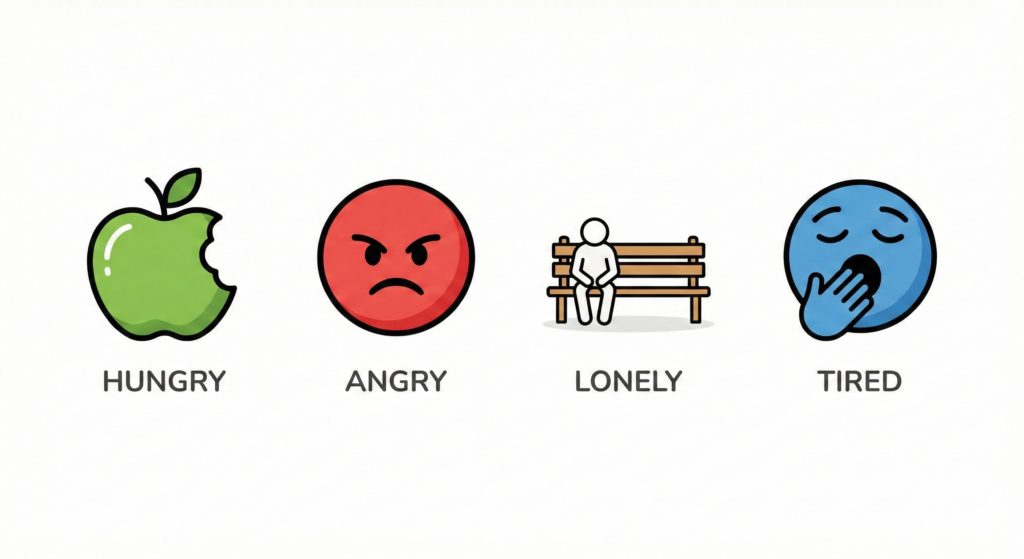

A great tool borrowed from psychology is the acronym H.A.L.T. Before you make a non-essential purchase, ask yourself: Am I Hungry, Angry, Lonely, or Tired?

If the answer to any of those is yes, close the shopping app. Eat a snack, take a nap, call a friend, or go for a walk to cool off. Address the actual physical or emotional need directly, rather than trying to cover it up with a purchase.

3. Stop “Fantasy Self” Spending

How many items in your closet still have tags on them?

Often, we buy things for our “fantasy self”—the version of us who runs five miles every morning at 5 AM, hosts elaborate dinner parties, or reads classic literature every night. When we buy the expensive running shoes or the pasta maker, we are buying the hope of becoming that person.

Be honest about who you are right now. Buy things for your actual life, not your fantasy life. It’s okay if your actual life involves watching Netflix in comfy sweatpants instead of running marathons.

4. Create a “Why” Visual

Saving money just to have money in the bank is boring. It’s hard to stay motivated by a number on a screen. You need a tangible “why.”

What does that money represent? Is it freedom from a job you dislike? Is it a down payment on a cozy home with a garden? Is it a debt-free wedding? Find an image that represents that goal and put it everywhere—your phone lock screen, your fridge, or taped to your credit card. When you are tempted to impulse buy, look at that image. Is the purchase worth delaying that dream?

5. Practice “Financial Gratitude”

Advertising works by making us feel lacking. It convinces us that we aren’t cool enough, pretty enough, or successful enough unless we buy their product. This constant state of “wanting” is exhausting and expensive.

The antidote to wanting is gratitude. Take five minutes once a week to look around your home and appreciate what you already own. Recognize that at one point, you really wanted the things you currently have. Shifting your mindset from “I need more” to “I have enough” is the most powerful financial move you can make.